Kentucky Unclaimed Property Reporting

KY HB456 2026 Regular Session LegiScan

KY HB456 | 2026 | Regular Session Status Spectrum: Partisan Bill (Republican 1) Status: Introduced on January 21 2026 - 25% progression Action: 2026-01-21 - to Committee on Committees (H) Pending: House Committee On Committees Committee Text: Latest bill text (Introduced) [PDF] Status: Introduced on January 21 2026 - 25% progression Action: 2026-01-21 - to Committee on Committees (H) Pending: House Committee On Committees Committee Text: Lates...

https://legiscan.com/KY/bill/HB456/2026

Kentucky treasurer's office aims to expand, streamline ...

requires Kentucky Power to file annual reports ... Kentucky treasurer's office aims to expand, streamline unclaimed property returns in 2026.

https://kypublicnotices.newzgroup.com/KYLegals/2026/70221-2026-01-06_1001.pdfKentucky treasurer's office aims to expand, streamline ...

Kentucky treasurer's office aims to expand, streamline unclaimed property returns in 2026 · Kentucky Lantern · Get our newsletters.

https://www.newsfromthestates.com/article/kentucky-treasurers-office-aims-expand-streamline-unclaimed-property-returns-2026Kentucky – National Association of Unclaimed Property Administrators (NAUPA)

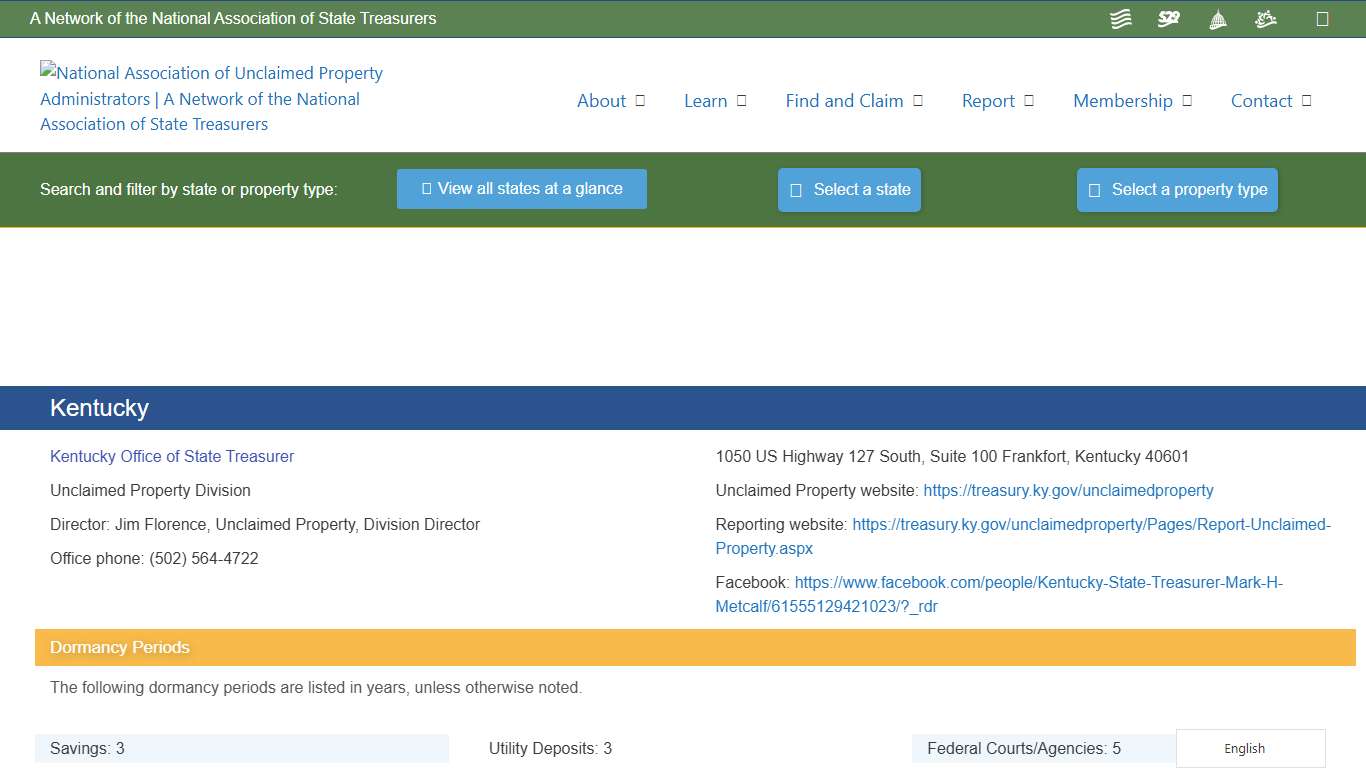

Dormancy Periods The following dormancy periods are listed in years, unless otherwise noted. Reporting and Payment Due Dates The following indicates the report and payment due dates for the various property types. Electronic Reporting Capability Schedule The following indicates which types of reporting formats are accepted by this state.

https://unclaimed.org/reporting/kentucky/

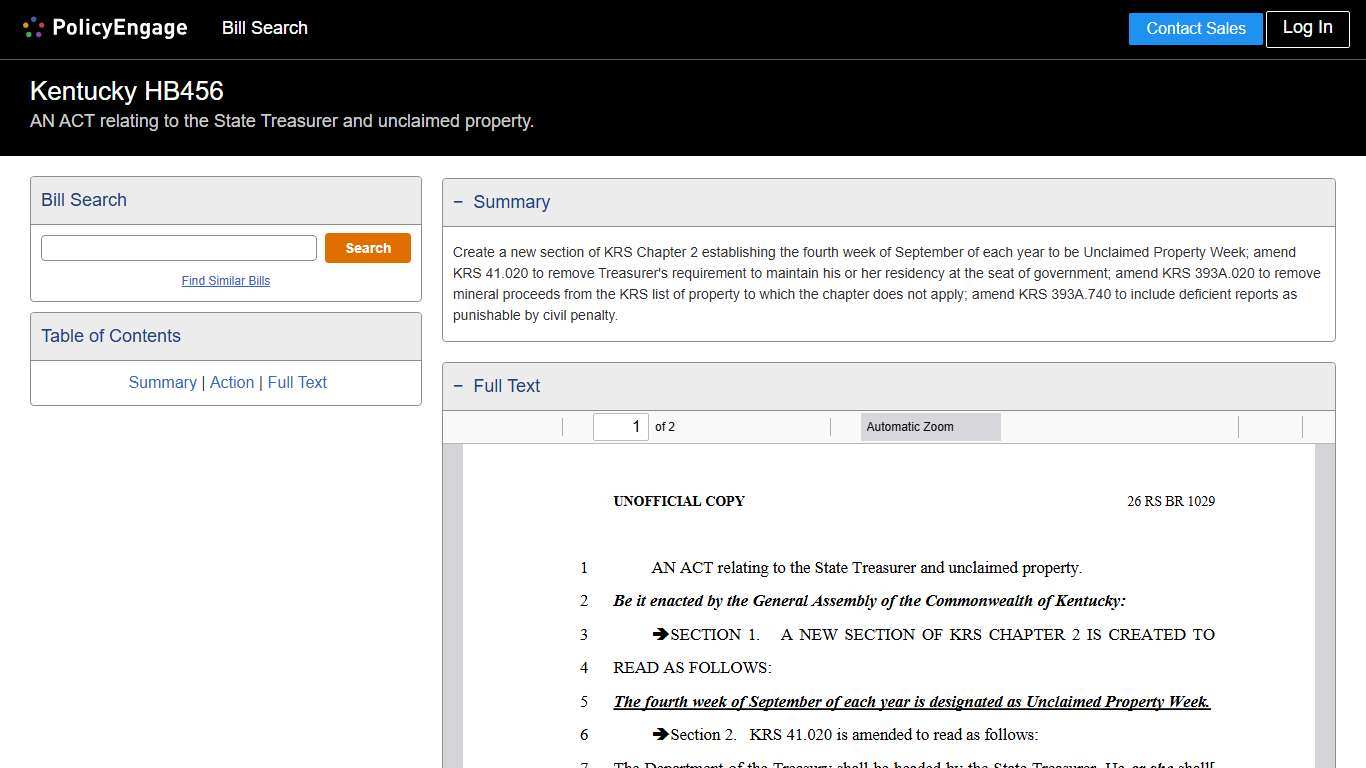

HB456 Kentucky 2026 AN ACT relating to the State Treasurer and unclaimed property. - Legislative Tracking PolicyEngage

− Summary Create a new section of KRS Chapter 2 establishing the fourth week of September of each year to be Unclaimed Property Week; amend KRS 41.020 to remove Treasurer's requirement to maintain his or her residency at the seat of government; amend KRS 393A.020 to remove mineral proceeds from the KRS list of property to which the chapter does not apply; amend KRS 393A.740 to include deficient reports as...

https://trackbill.com/bill/kentucky-house-bill-456-an-act-relating-to-the-state-treasurer-and-unclaimed-property/2786856/

record(20-1-2026).docx

Recognize January 22, 2026, as Kentucky Arts Day. Jan 16, 2026 - introduced in Senate; to Committee on Committees (S). Jan 20, 2026 - to ...

https://apps.legislature.ky.gov/record/26rs/record(20-1-2026).docxKentucky League of Cities

The Kentucky State Treasurer administers Kentucky’s Unclaimed Property Fund, which features nearly $800 million in assets. For cities and municipal agencies, unclaimed funds typically consist of taxes, insurance premiums, or other payments. For individuals, it generally consists of payroll checks, unclaimed safety deposit boxes, old life insurance policies, stocks, or vendor checks that have remained unclaimed by their owners after several years.

https://www.klc.org/News/13089/cities-could-have-money-in-treasurers-unclaimed-property-fund

25RS HB 566

Last updated: 7/24/2025 3:26 PM (EDT)...

https://apps.legislature.ky.gov/record/25rs/hb566.html

Kentucky implements major policy changes in 2026

LEXINGTON, Ky. (WKYT) - Kentucky will implement three significant policy changes on Jan. 1, 2026, affecting individual taxpayers, the state’s bourbon industry and consumer data privacy while cutting state and local revenues. The individual income tax rate will drop to 3.5%, a law that phases out Kentucky’s property tax on aging distilled spirits will go into effect, and a comprehensive consumer data privacy framework will establish new rights ...

https://www.wkyt.com/2025/12/30/kentucky-implements-major-policy-changes-2026/

State-by-State Reporting Information – National Association of Unclaimed Property Administrators (NAUPA)

Reporting website: https://treasury.ky.gov/unclaimedproperty/Pages/Report-Unclaimed-Property.aspx ... · National Association of Unclaimed ...

https://unclaimed.org/state-reporting/

A State Budget for an Affordable Kentucky: Preview of the 2026–2028 Budget of the Commonwealth - Kentucky Center for Economic Policy

In the 2026 legislative session, the Kentucky General Assembly will perform its most important job — crafting a two-year state budget that funds education, health, social services and other critical needs. But unlike recent years, when pandemic-era stimulus created robust revenue growth, lawmakers are now facing a serious budget crunch due to the loss of federal funds, a weakening economy and falling revenue because of state income tax cuts.

https://kypolicy.org/preview-of-the-2026-2028-kentucky-state-budget/

Unclaimed Property Focus - Unclaimed Property Professionals Organization

Unclaimed property continues to be a popular topic for state legislatures. Although a handful of state legislatures are still in session, most have completed their work. Following is a brief summary of some of the noteworthy unclaimed property bills that became law during the 2018 session.

https://www.uppo.org/blogpost/925381/Unclaimed-Property-Focus?tag=Kentucky